Verbal Verification Of Employment After Closing

Post-closing departments will at least occasionally confirm aspects of the file such as employment. 102716 and 121516 eff.

Verification Of Employment Before Closing Mortgage Guidelines

HR gave me a form which has my contract information and salary thats it.

Verbal verification of employment after closing. On the next screen scroll to Closing Deliverables and Click Order next to Verbal VOE. In your case i would have to think that the lender knew the circumstances surrounding your employment - they would have done a verification prior to closing. I just submitted this form to my lender but while we wait for the lenders response I was wondering if any of you have.

Per our current guidelines Verbal verifications of employment dated within 10 business days of the Note date will continue to be required. And although you think that would be enough documentation to supply to your lender you should also be ready for a verbal verification of income where your lender will call your employer and check to make sure you still work there and that youre still making the amount you claimed on your application many lenders also accomplish this task by asking your employer to fill out an employment verification. Most employers have an HR department.

Written VOEs and Verbal VOE. Its not enough to supply your paystubs or even your tax returns. Your employer is called no more than 10 days before the loan closure or 120 days if youre self-employed.

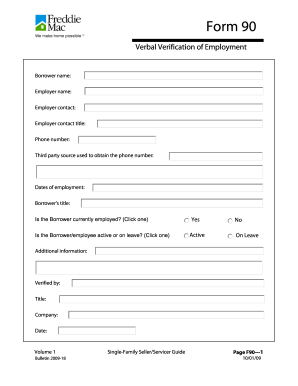

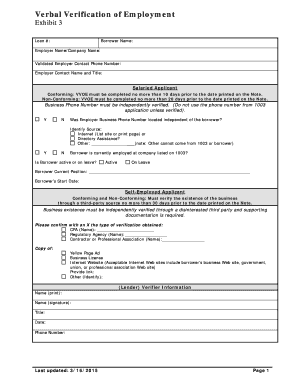

070617 Page F90-1 Form 90 Verbal Verification of Employment Borrower name. Verbal Verification of Employment VVOE is the process of verifying the employment status of each borrower on the mortgage application by contacting the borrowers employer over the phone. Defining the Verification of Employment.

The call is documented and your employment is confirmed with the employer. Lenders must obtain a verbal verification of employment verbal VOE for each borrower using employment or self-employment income to qualify. It is common for quality control to pull a sampling of loans to audit in order to assure Secondary Market Investors Fannie Freddie that the loans being closed and delivered to them meet ALL Underwriting guidelines and Fed Lending Disclosure Laws.

If youre self-employed youll be much more involved in the verbal verification of employment process. Verbal Verification of Employment. Get Matched with a Lender Click Here.

Final Verbal Verification of Employment. The verbal VOE must be obtained within 10 business days prior to the note date for employment income and within 120 calendar days prior to the note date for self-employment income. VERBAL VERIFICATION OF EMPLOYMENT.

Choose the method you verified the phone number through and fill in the nameposition of the person you spoke with. However in order to temporarily assist Sellers during this challenging time the verbal VOE VVOE may be substituted by a written VOE or Email VOE dated within the same time frame. Complete the date hired and the remaining fields.

Freddie Mac Single-Family SellerServicer Guide Bulletin 2016-23 Rev. The lender contacts the borrowers employer and verifies the employment and payroll information of the borrower. VVOE helps a lender confirm that the borrowers.

The verbal VOE requirement is intended to help lenders. Im worried about it being completed at my job. This topic has 4 replies 2 voices and was last updated 2 years 10 months ago by northgagurl.

The verbal VOE must be obtained within 10 business days prior to the note date for employment income and within 120 calendar days prior to the note date for self-employment income. This may be nothing more than a Post Closing Audit. Home Forums Purchase Program Final Verbal Verification of Employment.

They normally verify employment within 1-2 days before closing and will make you sign documents that will allow them to do it within 60days after closing if you dont tell them then youll have a problem where you can lose the new home and will be required to pay in full the whole mortgage balance. Lenders always verify employment before you close on a loan. A borrowers employment is a significant factor in determining the capacity of a borrower to repay a loan.

Viewing 5 posts - 1 through 5 of 5 total Author. Based on their knowledge you did get approved - perhaps your income wasnt a big consideration in the overall scheme of things. Again the process can vary depending on the lender but it typically goes as.

The verbal VOE requirement is intended to help lenders. Lenders must obtain a verbal verification of employment verbal VOE for each borrower using employment or self-employment income to qualify. To get the final VOE for a client click the link for Deliverable Tracking in the upper right section of the file header in Encompass.

The verbal VOE must be obtained within 10 business days prior to the note date for employment income and within 120 calendar days prior to the note date for self-employment income. We are closing next week and our lender told us that they need to verbally verify our employment. Lenders must obtain a verbal verification of employment verbal VOE for each borrower using employment or self-employment income to qualify.

However theyre not the only dangers home buyers face ahead of closing. This helps the lender determine that your income is as accurate as you reported. The HR department is the department that will do verification of employment.

Completion of this verification is required and a copy must be included in the loan file. Lenders need to hear from a third party that you are employed. Alternatively lenders may obtain the verbal VOE after closing.

My employer however does not verify employment status via email phone or on a lender form. Employment verification 3 months after closing. The last-minute verbal verification of employment and credit check are now routine.

There are two types of VOEs. October 15 2018 at 755 am 45672. The loan is closed and delivered.

Verification of employment often referred to as VOE is done during the mortgage process.

Fannie Mae Previous Employment Verification Jobs Ecityworks

Will Your Lender Verify Employment On The Day Of Your Closing Irrrl

Temporary Exceptions For Usda Appraisals Inspections And Employment Verification Usda Loan Pro

Desktop Underwriter Training Webinar Slides

Verification Of Employment Form Fill Out And Sign Printable Pdf Template Signnow

Verification Of Employment Before Closing Mortgage Guidelines

Verbal Voe Form Fill Out And Sign Printable Pdf Template Signnow

What Is Verification Of Employment For A Mortgage Proving Your Job History

Https New Content Mortgageinsurance Genworth Com Documents Training Course Income 20series 20part 201 20calculating 20 20documenting 20base 20income 20nov 202016 Pdf

Will My Lender Do An Employment Verification After Closing Clever Real Estate

Verification Of Employment Request Jobs Ecityworks

Verification Of Employment Voe For Va Loans

Https Fhlbmpf Com Docs Default Source Exhibit R Verbal Verification Of Employment Exhibit R Verbal Verification Of Employment Pdf Sfvrsn Ece67622 4

Https New Content Mortgageinsurance Genworth Com Documents Training Course Review 20calculate 20base 20income 20 20jan 202018 Pdf

Verification Of Employment Fill Online Printable Fillable Blank Pdffiller

Encompass Request For Verification Of Employment 2004 2021 Fill And Sign Printable Template Online Us Legal Forms

21st Mortgage Corporation Verification Of Employment Letter Fill And Sign Printable Template Online Us Legal Forms

Https New Content Mortgageinsurance Genworth Com Documents Training Course Income 20series 20part 201 20calculating 20 20documenting 20base 20income 20nov 202016 Pdf

Https Www Icba Org Docs Default Source Icba Crisis Response Coronavirus Fannie Mae Covid External Faqs Selling Pdf

Posting Komentar untuk "Verbal Verification Of Employment After Closing"